I remember the thrill, and honestly, a healthy dose of trepidation, when I first dipped my toes into the world of property investment. It wasn’t just about finding a good deal; it was about trying to glimpse into the future, to understand where those numbers – the prices of houses, apartments, commercial spaces – were headed. This is where the concept of property price forecasting truly captured my imagination. It felt like holding a slightly smudged crystal ball, trying to decipher the patterns and predict the next big move.

For many of us, property isn’t just bricks and mortar; it’s often the biggest financial decision we’ll ever make. Whether you’re a first-time buyer dreaming of your own little corner of the world, a seasoned investor looking to grow your portfolio, or even just someone curious about the value of your current home, understanding property price trends is paramount. It’s about making informed choices, mitigating risks, and ultimately, maximizing your chances of success in this often unpredictable market.

My initial approach was, I’ll admit, rather rudimentary. I’d pore over local newspaper real estate sections, chat with agents, and observe the general buzz in the neighborhoods I was interested in. I’d notice when a particular area started to get a lot of attention, when new amenities like parks or shopping centers were announced, and I’d intuitively feel that prices were likely to climb. But intuition, while valuable, can only take you so far. To truly navigate the complexities of property price forecasting, I realized I needed to dig deeper, to understand the forces that actually drive these fluctuations.

The Pillars of Property Price Prediction: What I Learned

Over time, through countless hours of research, conversations, and a few hard-won lessons, I began to piece together the fundamental drivers of property prices. Think of them as the bedrock upon which any forecast is built.

One of the most significant factors, and something I saw play out repeatedly, is Economic Health. It sounds obvious, but when the economy is booming, people have more disposable income, job security is high, and confidence levels are up. This naturally translates into a greater demand for housing. Conversely, during economic downturns, unemployment rises, consumer confidence plummets, and the demand for property, and therefore prices, tends to stagnate or fall. I remember a period when a major local employer announced significant layoffs; within months, the asking prices for homes in that vicinity noticeably softened. It was a stark reminder of how closely tied property markets are to the broader economic climate.

Then there’s the crucial element of Interest Rates. This is a big one for affordability. When interest rates are low, mortgages become cheaper, making it more attractive for people to borrow money and buy property. This increased demand pushes prices up. When interest rates rise, the cost of borrowing increases, reducing affordability and cooling down the market. I’ve witnessed firsthand how a single announcement from the central bank about interest rate hikes can send ripples of caution through the property world. Buyers become more hesitant, and sellers might need to adjust their expectations.

Supply and Demand is the classic economic principle, and it’s absolutely central to property price forecasting. If there are a lot of houses on the market and not many buyers, prices will likely fall. If there are few houses available and many eager buyers, prices will inevitably climb. I’ve seen this play out in rapidly developing suburbs where new housing construction can’t keep pace with population growth. Suddenly, that quiet street becomes highly sought after, and bidding wars become the norm. On the flip side, areas with a surplus of unsold properties can languish for months, with sellers having to make significant price reductions to attract any interest.

Location, Location, Location – this adage is as true as ever, and it’s not just about a prestigious postcode. It’s about what the location offers. Proximity to good schools, reliable public transportation, employment hubs, parks, and amenities all contribute to a property’s desirability and, consequently, its price. I’ve observed how the announcement of a new train station or a major shopping complex can instantly revitalize a neighborhood and boost property values. Conversely, areas experiencing a decline in essential services or an increase in crime can see their property values suffer.

Government Policies and Regulations also play a significant role. Think about things like zoning laws, property taxes, incentives for first-time buyers, or changes in landlord-tenant regulations. These can all influence the supply of housing, the cost of ownership, and the overall attractiveness of the property market. For example, a government initiative to encourage foreign investment in property could lead to increased demand and higher prices in certain segments.

Demographic Shifts are another fascinating, long-term driver. An aging population might lead to increased demand for smaller, accessible homes or retirement communities. A younger, growing population, on the other hand, might drive demand for family homes in suburban areas. I’ve seen how migration patterns, both internal and international, can create pockets of intense demand in specific regions.

My Foray into Forecasting Tools and Techniques

Once I understood these fundamental drivers, I started exploring more sophisticated ways to forecast property prices. It’s not about having a magic formula, but about using data and analysis to make more educated guesses.

One of the first things I encountered was the power of Historical Data Analysis. Looking at past price trends in a specific area can reveal patterns. Are prices generally trending upwards? Are there seasonal fluctuations? Have there been significant peaks and troughs? While past performance isn’t a guarantee of future results, it provides a valuable baseline. I started using online real estate portals that offered historical price data for specific properties and neighborhoods. It was like looking at a graph of a patient’s vital signs – you could see the general health and identify any concerning dips or exhilarating spikes.

Then came Statistical Modeling. This is where things get a bit more technical, but the core idea is to use mathematical and statistical techniques to identify relationships between various factors (like interest rates, employment figures, new housing starts) and property prices. I’m not a statistician, but I learned to appreciate the outputs of these models. They can help identify correlations that might not be immediately obvious. For instance, a model might reveal that a 1% increase in average income in a city is consistently linked to a 2% rise in property prices over a certain period.

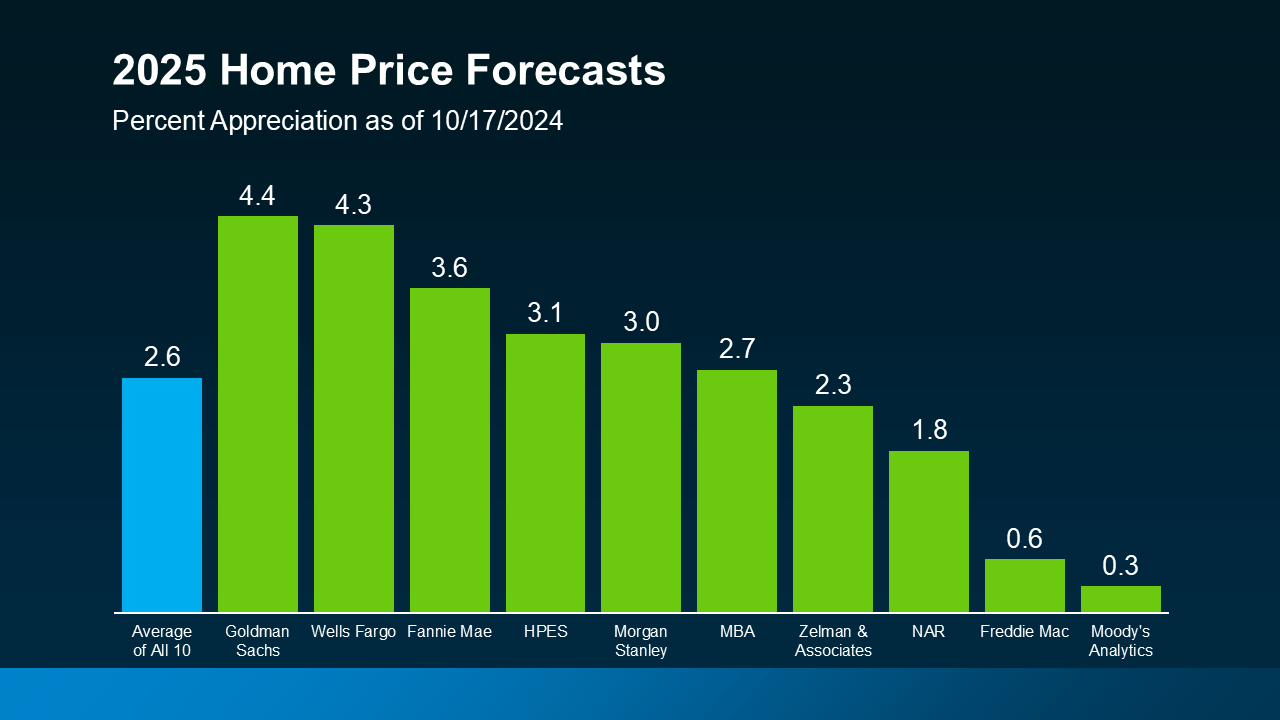

Expert Opinions and Market Sentiment are also vital. While data is crucial, the qualitative aspect of the market – what experts are saying, what buyers and sellers are feeling – cannot be ignored. Real estate agents, economists, and market analysts often have a finger on the pulse of the market that raw data alone might miss. I made it a habit to read industry reports, attend webinars, and follow reputable property commentators. Their insights often provided context and helped me interpret the numbers.

Geographic Information Systems (GIS) are another powerful tool, especially for understanding micro-market trends. GIS allows for the visualization and analysis of spatial data. You can map out crime rates, school catchment areas, proximity to transport, and even the density of amenities. Overlaying this with property sales data can reveal highly localized trends that might be missed in broader analyses. I found this particularly useful when looking at smaller, up-and-coming neighborhoods.

Predictive Analytics and Machine Learning are the cutting edge. These techniques use algorithms to analyze vast amounts of data and identify complex patterns that human analysts might not be able to detect. Machine learning models can learn from new data as it becomes available, continuously refining their predictions. While this is often the domain of larger investment firms, the underlying principles are becoming more accessible, with some platforms offering AI-powered property market insights.

My Personal Journey: From Novice to Informed Investor

It hasn’t been a straight line, this journey into property price forecasting. There have been times when my predictions felt spot on, and others where the market threw me a curveball. I remember one instance where I was very bullish on a particular suburban area due to its proximity to a planned new tech hub. I invested, expecting prices to skyrocket. However, due to unforeseen planning delays and a shift in economic focus, the development stalled, and prices remained relatively flat for longer than I anticipated. It was a valuable lesson in patience and the inherent unpredictability of long-term projects.

On the other hand, I’ve also had successes where understanding the interplay of factors led to profitable investments. In one case, I identified an area with strong rental demand driven by a nearby university and a lack of new rental developments. By analyzing historical rental yields and factoring in projected student enrollment figures, I was able to forecast a steady increase in rental income, which in turn supported property value growth.

The key, I’ve found, is to be holistic in your approach. Don’t rely on just one indicator. Combine economic data, local market specifics, government policies, and expert opinions. Be prepared to adapt your forecasts as new information emerges. The property market is dynamic, and what was true six months ago might not be true today.

Tips for the Aspiring Property Price Forecaster

If you’re just starting out and feeling a bit overwhelmed, here are a few things that helped me:

- Start Local: Focus on a specific neighborhood or a few areas you know well. Understand the local nuances, the types of properties, and the demographic makeup.

- Educate Yourself Continuously: Read property news, market reports, and economic analyses. The more you learn about the drivers of the market, the better equipped you’ll be.

- Understand Affordability: Keep a close eye on interest rates and income levels. These are fundamental to how many people can afford to buy.

- Look at Supply Pipeline: What new developments are planned? How many properties are currently for sale? This will give you insight into future supply.