I remember the day I bought my first house. It wasn’t a mansion, not by a long shot. It was a modest, two-bedroom bungalow in a quiet suburban neighborhood. The paint was a little faded, the garden needed some serious attention, and the kitchen felt…well, let’s just say it was a product of its time. But to me, it was everything. It was mine. And little did I know, that little bungalow would become the cornerstone of my financial future, thanks to something called property equity growth.

For a long time, the word "equity" felt like some jargon thrown around by real estate agents and bankers. I understood that when you pay down your mortgage, you own more of the house. That made sense. But the "growth" part? That was the mystery. It felt like this abstract concept that happened to other people, people who bought in booming markets or owned multiple properties. I was just a regular person trying to make my mortgage payments on time.

My journey with property equity growth wasn’t a sudden, dramatic event. It was a slow burn, a gradual realization that unfolded over years. I bought the house with a pretty standard mortgage. The initial years were focused on just getting by, making sure the bills were paid, and slowly chipping away at the principal. I’d look at my mortgage statement every month, see the balance decrease by a tiny bit, and feel a sense of accomplishment. But the actual value of the house? That felt like a black box.

Then, a few years in, the neighborhood started to change. More young families moved in, drawn by the good schools and the sense of community. People started renovating their homes, adding extensions, and landscaping their gardens. Suddenly, my little bungalow, which I’d always seen as just a starter home, began to look a lot more attractive. I’d walk around and see other houses on the street getting significant upgrades, and I’d wonder, "What’s happening to my house’s value?"

This curiosity led me down a rabbit hole of learning about real estate. I started reading articles, listening to podcasts, and even attending local real estate investor meetups (which, by the way, are surprisingly friendly and not at all intimidating once you go to one). I learned that property equity growth isn’t just about paying down your mortgage. It’s a two-pronged beast.

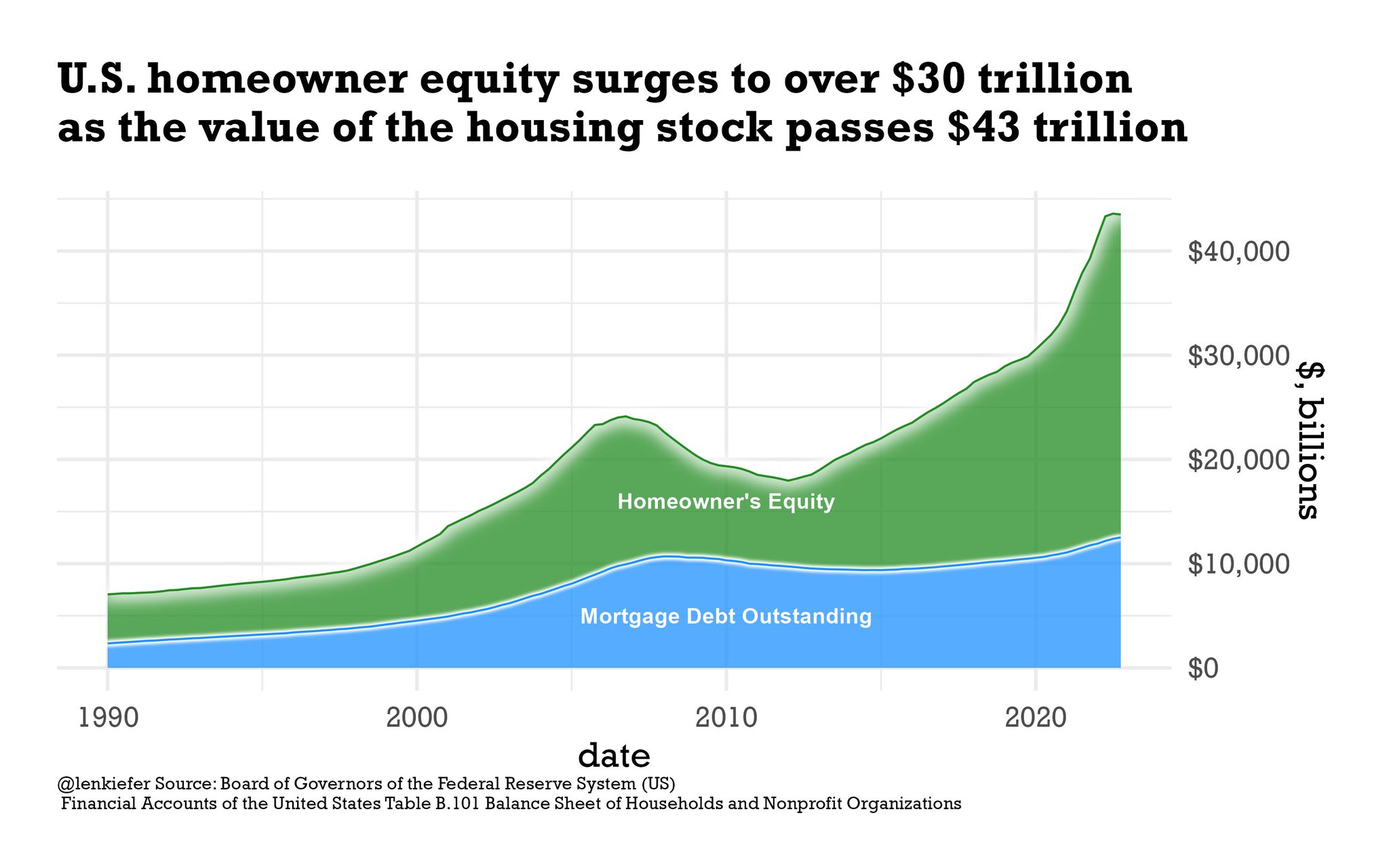

The first, and the one I was already familiar with, is loan paydown. Every mortgage payment you make, a portion goes towards the interest, and a portion goes towards reducing the principal loan amount. As your principal balance shrinks, the percentage of the home you own outright increases. So, if you bought a $300,000 house with a $60,000 down payment (20%), you have $240,000 in debt. Your initial equity is $60,000. As you pay down that debt, your equity grows. It’s a direct, quantifiable increase.

But the real magic, the part that truly surprised me, was the second driver: appreciation. This is where the market comes into play. Appreciation is the increase in the value of your property over time. This can happen for a multitude of reasons. Sometimes, it’s driven by broader economic factors – inflation, low interest rates, or a strong job market in the area that increases demand for housing. Other times, it’s more localized.

In my neighborhood’s case, it was a combination. The general economic climate was favorable, but the local improvements were the real catalysts. New businesses opened, parks were upgraded, and the overall desirability of the area increased. People were willing to pay more for homes in this community.

I remember one specific moment that really solidified this for me. I was getting ready to refinance my mortgage, and the bank sent an appraiser to my house. I was nervous, thinking about all the imperfections. But when the appraisal report came back, my jaw dropped. The value of my house had increased by almost 40% since I bought it, and I had only paid down a small fraction of the mortgage in that time. The appreciation alone had added a significant chunk to my equity.

So, let’s break down how this happens in a way that makes sense. Imagine your house is a pie. Initially, when you buy it, a big slice of that pie belongs to the bank (your mortgage), and a smaller slice is yours (your down payment). As you make mortgage payments, your slice of the pie gets bigger, and the bank’s slice gets smaller. That’s the loan paydown.

Now, imagine that over time, the whole pie itself gets bigger. Maybe someone bakes a new, delicious filling into it, or adds a few extra berries to the topping. That’s appreciation. The market value of your home increases, making the entire pie larger. Even if your slice of ownership hasn’t increased much through loan paydown, the overall value of your slice is now worth more.

This combination of loan paydown and appreciation is what builds your property equity. It’s not just about having a place to live; it’s about building wealth passively. And the beauty of it is, you don’t have to do anything particularly complex. Consistent mortgage payments and living in an area that’s likely to see value increases are the fundamental ingredients.

Of course, there are factors that can influence how quickly your equity grows. Location, location, location, as they say, is paramount. A property in a declining area might see its value stagnate or even decrease. Conversely, a property in a rapidly developing or desirable area is more likely to experience significant appreciation.

The condition of your property also plays a role. While the market can drive appreciation, a well-maintained home in good condition will always be more attractive to buyers and will likely command a higher price than a neglected one. I, myself, started doing small improvements. I repainted the interior, tackled the overgrown garden, and updated some of the older fixtures. These weren’t massive renovations, but they made the house more appealing and, I believe, contributed to its increased value.

Another crucial element is the time horizon. Property equity growth is rarely an overnight sensation. It’s a long-term strategy. The longer you own a property, the more time you have to benefit from both loan paydown and market appreciation. Trying to flip a property quickly might be a different strategy, but for building substantial equity, patience is key.

For beginners, the idea of using property equity for financial gain can seem daunting. But it doesn’t have to be. Once I understood the concept, I started looking at my home not just as shelter, but as an asset. This shift in perspective opened up new possibilities.

For instance, once my equity grew significantly, I was able to tap into it. This is often done through a home equity loan or a home equity line of credit (HELOC). I decided to take out a HELOC to fund some larger renovations on my house, not just for aesthetics but to further increase its value. I also used some of that equity to invest in other areas, like starting a small business. It felt empowering to leverage an asset I already owned to create more wealth.

It’s important to be smart about using your equity, though. Taking out a loan against your home is a significant financial decision. You need to have a clear plan for how you’ll use the funds and ensure you can comfortably afford the repayments. For me, the renovations were a strategic investment that I believed would yield a return when I eventually sold the property.

The story of my little bungalow is a testament to the power of property equity growth. It’s not about being a sophisticated investor from day one. It’s about understanding the fundamentals, making smart choices, and letting time and the market work in your favor.

For anyone just starting out, here’s what I’d suggest, based on my own experience:

- Start with what you can afford: Don’t overextend yourself. A starter home, even if modest, is a starting point.

- Focus on loan paydown: Make your mortgage payments consistently. Consider making extra principal payments when you can, even small ones.

- Research your location: Look for areas with good fundamentals – strong job markets, good schools, and signs of development or desirability.

- Maintain your property: Small improvements can make a big difference in maintaining and increasing your home’s value.

- Educate yourself: Keep learning about real estate and personal finance. The more you know, the more confident you’ll be in your decisions.

- Be patient: Property equity growth is a marathon, not a sprint.

My property equity journey wasn’t filled with dramatic market swings or risky ventures. It was built on the steady rhythm of mortgage payments and the gradual, often unseen, appreciation of my home. That little bungalow, once just a house, transformed into a significant part of my financial security and a powerful engine for future growth. It taught me that owning property is more than just having a roof over your head; it’s about building a foundation for a more prosperous future. And that, for me, is a story worth telling.